Beyond the Busywork: How Advisors Can Reclaim Their Passion

Todd Fithian, CEO & Co-Founder of The Legacy Companies, LLC

Financial advising can be a very fulfilling career. Helping people achieve their financial goals, build a secure future, and create a meaningful life can be very rewarding. But for many advisors, the initial thrill of developing business and working with clients can morph into a relentless grind. As their business grows, the joy of working directly with clients gets overshadowed by the ever-growing mountain of operational tasks.

This phenomenon, often referred to as the “practitioner’s dilemma,” is a major roadblock for financial advisors seeking to achieve long-term success. Caught between the desire to serve clients and the necessity to manage a business, advisors can find themselves stretched thin, their effectiveness diminished, and their vision for the future fading.

The good news is that there’s a solution. By embracing a structured approach, advisors can break free from the daily grind of operations and refocus on what truly matters: building strong client relationships and delivering exceptional service. This article explores the power of organizational structure and the importance of having the right people in the right roles within a financial advisory business.

The Practitioner’s Dilemma: When Operational Tasks Stifle Advisor Growth

Many advisors start their career with a singular focus: serving their clients. They thrive on meeting new people, solving the challenges of financial needs, crafting personalized plans, and guiding clients towards a brighter financial future. This “production” aspect of the business – finding, engaging with, and helping clients – is where most advisors find their passion and purpose.

However, as a business grows, the demands of client service and managing a team multiply. With more clients comes an increase in meetings, the need for in-depth analysis of complex financial situations, and the ongoing challenge of balancing communication with everyone. A larger team requires managing tasks like performance reviews, establishing compensation and benefit plans, assessing training needs, interviewing new candidates, motivating the team, and providing regular feedback. Soon, advisors find themselves not only managing client relationships but also managing a team and wrestling with a growing list of operational tasks.

These operational tasks – scheduling appointments, managing paperwork, ensuring compliance, leading a team and overseeing administrative duties – can be time-consuming and tedious. While essential for the smooth functioning of the business, they often fall outside the advisor’s core competencies and diminish their capacity to serve clients effectively and grow the business.

This is the heart of the practitioner’s dilemma. Advisors become bogged down in operations, their days filled with tasks that don’t leverage their expertise or ignite their passion. The joy of meeting new clients and solving their financial challenges recedes, replaced by a sense of overwhelm and frustration. They seek to escape the operational weeds and get back to what truly matters: building meaningful connections with prospects and clients and making a positive impact on their financial lives.

The Power of Structure: A Clear Framework for Growth

The key to overcoming the practitioner’s dilemma is a structured approach to building a team. A well-defined organizational structure provides a clear framework for allocating tasks, delegating responsibilities, and ensuring everyone within the business operates with focus and efficiency.

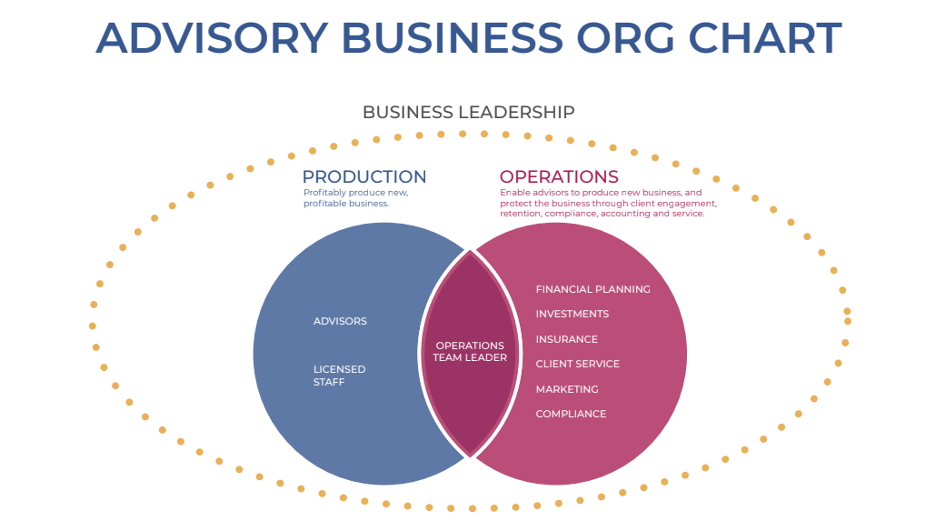

The Advisory Business Org Chart is a Venn diagram that shows the two major functions of the business – Production and Operations, as well as the need for Business Leadership.

Production: This circle encompasses all activities related to bringing new, profitable clients into the business. It includes prospecting, meeting with clients, and providing ongoing financial advice. Licensed Advisors occupy this space.

Operations: This circle represents the tasks that enable production and protect the business. It includes marketing activities, client onboarding, account administration, compliance oversight, bookkeeping, and other administrative functions. Operations staff, such as investment operations, insurance operations, marketing associates, support personnel, and compliance specialists, typically handle these tasks.

Business Leadership: For leaders and owners of financial service businesses, it’s essential to define a clear and inspirational vision for the business; one that excites them and ignites the passion and commitment of every team member.

The ideal scenario for a growing business is to have a dedicated team responsible for the operations circle, freeing advisors to focus on the production circle. However, in the early stages of growth, the overlap between these two circles can be significant.

This overlap represents an area of challenge, where advisors often get stuck. They juggle tasks from both production and operations, leading to inefficiency, frustration, and a potential for errors. Here’s where the concept of the Operations Team Leader becomes crucial.

The Operations Team Leader: The Bridge Between Production and Operations

The Operations Team Leader plays an important role in a well-structured financial advisory business. This individual sits at the overlap between the production and operations circles in the Venn diagram.

They act as a bridge, ensuring smooth communication and collaboration between advisors and operational staff with a goal of moving the business forward towards its defined vision and goals.

Here are some of the key responsibilities of an Operations Team Leader:

- Managing the Operational Team: They oversee the day-to-day activities of the operations staff, ensuring tasks are completed efficiently and accurately.

- Facilitating Workflow: They establish clear processes and procedures for client onboarding, account management, and other operational functions.

- Supporting Advisors: They anticipate the needs of advisors and proactively provide the resources and information they require to successfully onboard new clients.

- Quality Control: They ensure that all operational tasks are completed in compliance with industry regulations and the standards of the business.

- Performance Reviews: They take to lead on performance reviews for the operational team freeing advisors to focus on bringing new profitable clients into the business.

- Data & Reporting: They oversee business performance ensuring the collection of client data is efficient for the operations team to analyze and make informed recommendations for the advisors to present.

The Operations Team Leader is a strategic asset for any financial advisory business. They free advisors from the operational burden, allowing them to focus on building strong client relationships. Additionally, an effective Operations Team Leader can:

- Identify Areas for Improvement: They can analyze operational processes and identify areas for streamlining, cost-reduction, and efficiency gains.

- Promote Scalability: They can establish a framework for scaling the business with minimal disruption as the client base grows.

- Reduce Risk: By ensuring compliance and overseeing process execution, they help mitigate risks associated with operational errors and regulatory breaches.

Investing in an Operations Team Leader is an investment in the future of the business. It streamlines operations, and empowers the team to deliver exceptional service, ultimately freeing up the advisor and leading to a thriving financial advisory business.

Building a Client-Centric Culture: The Power of Structure and People

By building a well-structured team with a dedicated Operations Team Leader, advisors can cultivate a client-centric culture within their business. Here’s how this structure fosters a more client-focused environment:

- Focus on Advisor Strengths: Advisors can dedicate themselves to developing their core competencies, such as their people skills, networking capabilities and overall sales strategy.

- Streamlined Operations: Clear processes and procedures ensure timely delivery of essential services, improving the overall client experience.

- Enhanced Communication: Dedicated operational staff handle routine inquiries and administrative tasks, allowing advisors to focus on in-depth client conversations and strategic financial planning.

- Consistency: Clearly defined roles and responsibilities ensure a consistent client experience across the board.

- Scalability for Growth: A well-structured team can readily adapt to accommodate an expanding client base, ensuring clients continue to receive personalized attention.

Creating a client-centric culture goes beyond structure; it requires hiring the right people. Here are some key considerations when building the team:

- Technical Skills: Operational staff need the technical skills to manage tasks like data entry, account administration, and compliance processes.

- Client Service Orientation: Everyone on the team should embody a client-first mentality, striving to deliver exceptional service at every touchpoint.

- Communication Skills: Strong communication is vital for both internal collaboration and effective interaction with clients.

- Problem-Solving Skills: The ability to identify and resolve issues efficiently is crucial for ensuring smooth operations and client satisfaction.

Investing in a strong team, coupled with a well-defined organizational structure, empowers advisors to achieve their full potential. By leveraging the expertise of others and focusing on their core strengths, advisors can create a thriving business that delivers exceptional client service and drives sustainable growth.

Putting It All Together: A Roadmap to Success

If you’re ready to overcome the practitioner’s dilemma and build a thriving financial advisory business, here’s a roadmap to guide you:

- Assess the Current Structure: Look at the current team that is in place and how tasks are currently allocated. Identify areas where you’re spending time on operational tasks that could be delegated.

- Establish a Clear Vision: Define a clear and compelling vision for the future of the business, that will align the team to a common purpose.

- Consider Hiring an Operations Team Leader or Elevating an Existing Employee: No matter the size of the business, an Operations Team Leader can be a game-changer. Look for someone with experience in financial services operations and a strong understanding of client service.

- Define Roles and Responsibilities: Clearly define the roles and responsibilities for all team members, including advisors, operational staff, and any additional support personnel.

- Invest in Team Development: Provide ongoing training and development opportunities for the team to ensure they have the skills and knowledge to excel in their roles.

- Foster Communication and Collaboration: Establish clear communication channels and encourage collaboration between advisors and operational staff.

- Prioritize Client Service: Ensure that every interaction within the business reflects a client-centric focus. Empower the team to go the extra mile to deliver exceptional service.

By following these steps and embracing a structured approach to team building, advisors can free themselves from the grind of operations and refocus on their passion and what truly matters: building lasting relationships with their clients and guiding them towards a brighter financial future. A thriving financial advisory business isn’t built by one person alone. It’s the result of a well-structured team, with the right people in the right roles, all working together towards a shared vision of client service and success.